The Latest Articles from NCLC

Read NCLC's analysis of the latest changes to consumer law and their practice implications.

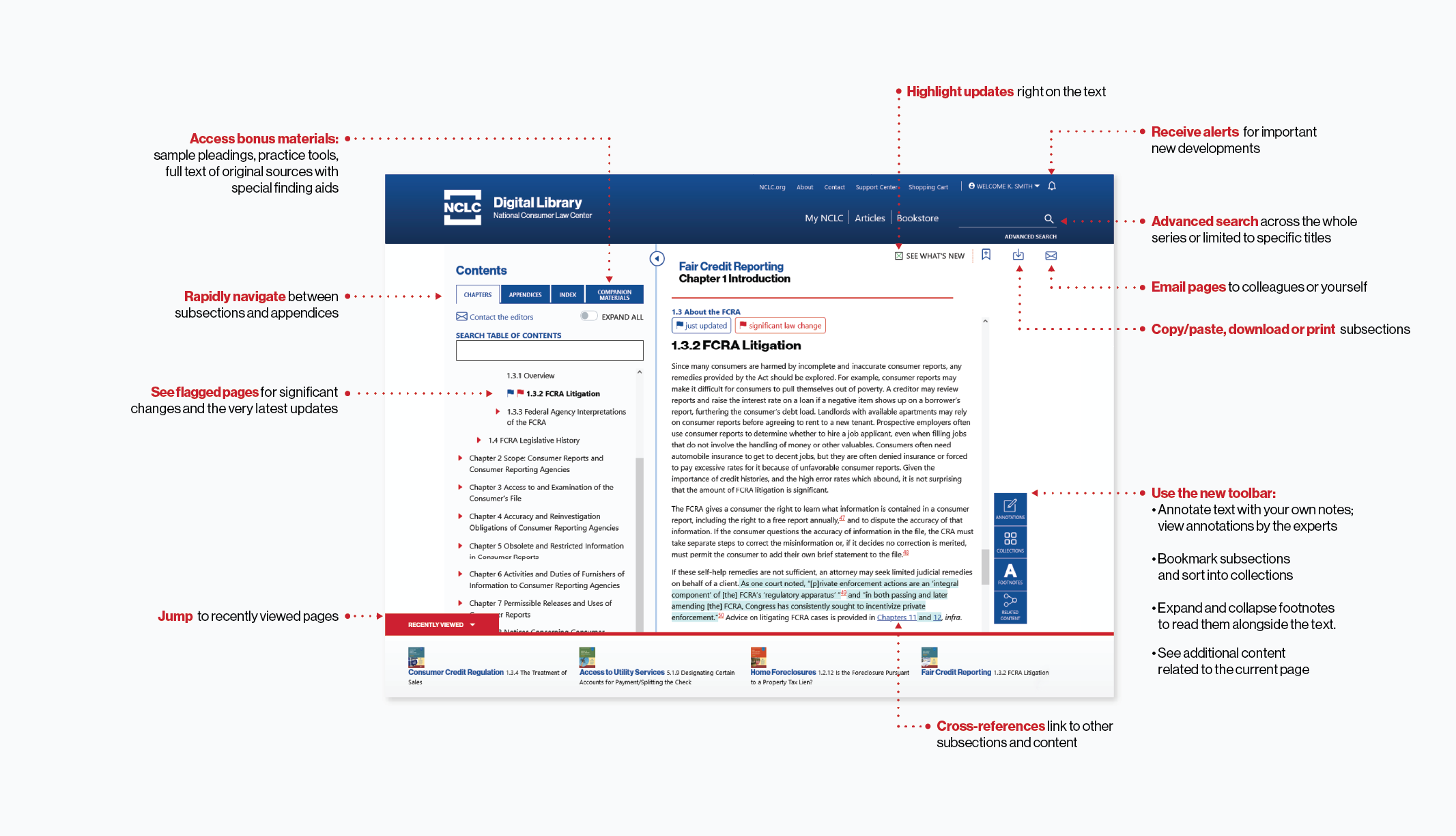

Preview NCLC's Consumer Law Treatises

Click on a title to view its table of contents and read its first chapter

Fair Debt Collection

The leading treatise on the federal Fair Debt Collection Practices Act (FDCPA), the statute that dramatically alters how collection agencies, debt buyers and attorneys collect consumer debts. Authored by experts who bring decades of experience on FDCPA litigation, legislation, and interpretations. Now including The FDCPA Case Connector, a searchable database of 14,000 FDCPA case holdings.

Fair Credit Reporting

The treatise explains the latest changes in credit reporting resulting from CFPB actions and those of the state attorneys general, as well as thousands of new FCRA court decisions. Also covered are the Credit Report Organizations Act, Gramm Leach Bliley, and state credit reporting statutes.

Mortgage Servicing and Loan Modifications

The most complete and up to date treatise on homeowner rights and remedies dealing with mortgage servicers, plus rights to delay and modify mortgage payments.

Student Loan Law

The Seventh Edition of Student Loan Law keeps readers current on all of these changes with comprehensive explanations of all student loan borrower rights and relief programs. The treatise includes new rights for loan cancellation, income-based repayment options, and tactics for challenging collector, servicer, private loan, and school abuses.

Free @ NCLC

Image

Two free books, 11 practice checklists, a student loan toolkit training materials, consumer law statutes & regs, and more — all publicly accessible on the NCLC Digital Library.

Federal Practice Manual for Legal Aid Attorneys

Image

NCLEJ's Federal Practice Manual for Legal Aid Attorneys guides legal aid and public interest lawyers through all stages of federal litigation. The Revised 2024 Edition provides the most comprehensive expertise for practitioners litigating on behalf of low-income and disadvantaged clients against government defendants. This edition is currently free to the public.